Shares of Intel (NASDAQ: INTC) are down around 22% since Jan. 25, when the company reported fourth-quarter 2023 earnings. The company posted revenue growth of 10% year over year, beating Wall Street estimates by $230 million. During the quarter, Intel enjoyed significant gains from a recovering PC market. But that wasn’t enough to overshadow weak guidance that sent its stock tumbling.

Intel expects Q1 2024 earnings to reach $0.13 per share when analysts forecasted $0.42 per share. Meanwhile, the company projects revenue to come in between $12 billion and $13 billion, less than the $14 billion that Wall Street expected.

However, weak guidance is why it’s crucial to keep a long-term perspective when it comes to tech stocks, and even more so when it comes to those expanding in artificial intelligence (AI). Intel has had a challenging few years, but is restructuring its business to prioritize profits while also investing in high-growth sectors like AI.

As a leading chipmaker, the company has massive potential in AI over the long term, which could see its stock skyrocket. So here’s one AI stock that could make you a millionaire.

Intel is overhauling its business to prioritize profitability

Intel has had a challenging few years, to say the least. The company was responsible for more than 80% of the central processing unit (CPU) market for at least a decade and was the primary chip supplier for Apple‘s MacBook lineup for years. However, Intel’s dominance saw it grow complacent, leaving it vulnerable to more innovative competitors.

Chip rival Advanced Micro Devices started eating away at Intel’s CPU market share in 2017, with Intel’s share now down to 69%. Then, in 2020, Apple cut ties with Intel in favor of more powerful in-house hardware designs.

However, the fall from grace has seemingly lit a fire under Intel again, and the company is making moves to come back strong in the coming years. Last June Intel announced a “fundamental shift” to its business strategy, adopting an internal foundry model that it believes will help it save $10 billion by 2025.

The move will see Intel transform from being primarily an integrated device manufacturer to a business similar to Taiwan Semiconductor Manufacturing, becoming a major provider of foundry capacity in North America and Europe. Intel says a foundry-style relationship with its manufacturing group could increase efficiency and profitability, enabling it to hit non-GAAP gross margins of 60% and operating margins of 40%.

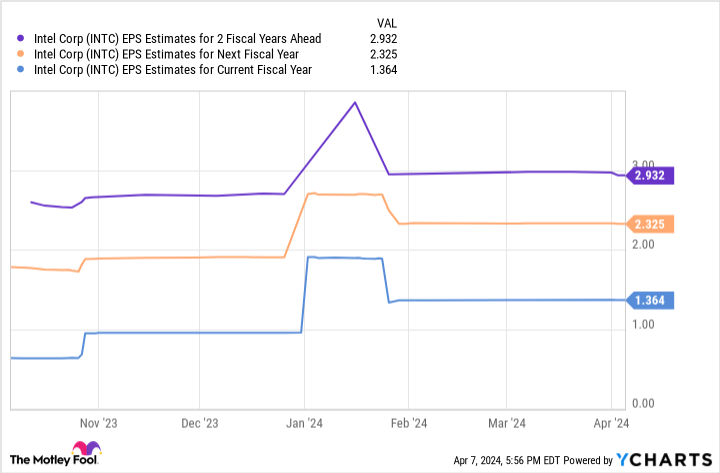

Earning per share estimates show a 118% upside over the next two years

In addition to a shift in business models, Intel is heavily investing in AI, a market projected to reach nearly 2 trillion by 2030. The company debuted a range of AI chips last December, including Gaudi3, a graphics processing unit (GPU) designed to challenge similar offerings from market leader Nvidia.

Additionally, Intel showed off new Core Ultra processors and Xeon server chips, which include neural processing units for running AI programs more efficiently.

Chip stocks skyrocketed last year alongside a boom in AI as demand for GPUs soared. Nvidia took center stage, with its shares rising 239% in 2023, while AMD’s stock rose 127%. Intel’s stock also saw significant growth, increasing 90% last year. However, its more moderate rise means Intel’s shares are trading at a better value than its two biggest chip rivals.

For reference, Intel’s forward price-to-earnings ratio (P/E) is 28, making it a better value than AMD’s 47 and Nvidia’s 35. Forward P/E is a helpful valuation metric calculated by dividing a stock’s current share price by its estimated earnings per share (EPS). The lower the figure, the better the value. And in Intel’s case, its stock is trading at a bargain compared to its rivals.

Moreover, this chart indicates Intel’s earnings could hit nearly $3 per share over the next two fiscal years. When multiplying that figure by the company’s forward P/E, you get a stock price of $85.

Looking at its current position, these projections could see Intel’s stock soar 118% by fiscal 2026. With its expanding position in AI, Intel is a screaming buy right now and one that could make you a millionaire with the right investment.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

1 Artificial Intelligence (AI) Stock That Could Make You a Millionaire was originally published by The Motley Fool