When the S&P 500 is up big on the year, it’s easy to miss the value of reliable dividend stocks. After all, what good is a 3% yield if the market is up nearly 20%?

But the value of quality dividend stocks isn’t how they perform during a strong market — it’s that they deliver regular quarterly payments no matter what the market is doing. The best dividend-paying companies take it a step further by raising their dividends every year, even during recessions. That way, investors can count on a growing income stream when they need it most.

Coca-Cola (NYSE: KO), Clorox (NYSE: CLX), and Target (NYSE: TGT) have raised their dividends every year for decades. Here’s why each stock is worth buying before the end of the year.

Coca-Cola’s moat was put on display this year

Depending on whom you ask, Coca-Cola stock could have a phenomenal or mediocre reputation. The easiest criticism is that Coke is a low-growth, market-underperforming stock that isn’t worth owning. But proponents of Coca-Cola will argue that the company’s track record of dividend raises and buybacks, as well as its wide moat, make it worth owning.

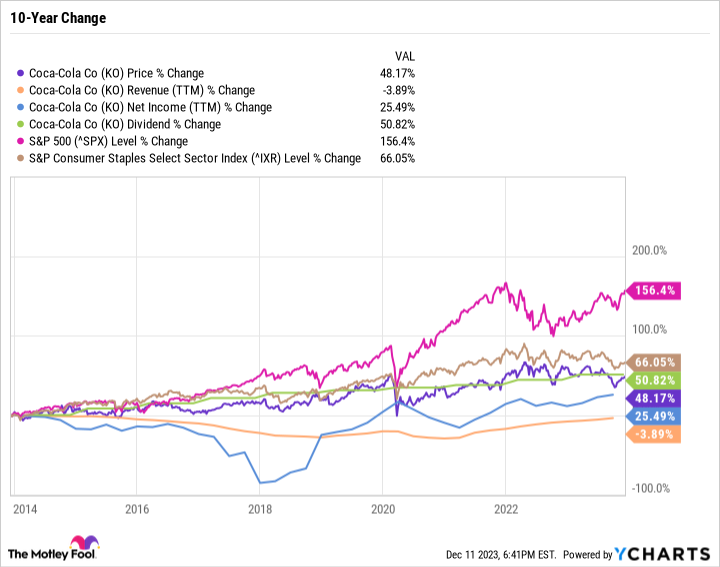

Coke’s 10-year chart is certainly disappointing. Its trailing-12-month revenue is actually lower today than it was a decade ago. Meanwhile, net income is up just 26% in 10 years and the stock is up just 43% compared to a 150% gain in the S&P 500. However, the consumer staples sector tends to underperform strong bull markets. Coca-Cola’s underperformance isn’t so bad when you compare it to the sector instead of the S&P 500.

Coke’s redeeming quality is its history of dividend raises. Coke is one of the longest-tenured Dividend Kings, having paid and raised its dividend for 61 consecutive years. The dividend has increased by over 50% in the last decade alone. And over the past year, Coke has achieved strong bottom-line growth thanks to price increases, proving its brand’s power and ability to combat inflation.

Investors who care more about capital preservation than capital appreciation will probably gravitate toward Coke’s pros outweighing the cons. The trick is to get the stock at a good price. Coke’s 24 price-to-earnings (P/E) ratio is reasonable relative to the S&P 500. With a 3.1% dividend yield, now is a good time to buy Coke if it aligns with your financial goals.

Time to start valuing Clorox normally again

Earlier this fall, Clorox stock underwent a swift and brutal sell-off, largely due to a cyberattack. The stock has recently been recovering is now up 22% from its 52-week low. But zoom out, and the stock is essentially flat year to date.

Like Coke, Clorox has a portfolio of strong brands that support stable dividend increases. In addition to the flagship Clorox brand, Clorox owns Burt’s Bees, Glad trash bags, Brita water filters, Kingsford charcoal, and more. There’s a bit more potential growth with Clorox than with Coke, given the product categories Clorox is in and the fact that Clorox’s market capitalization is far smaller than Coke’s. But Clorox is still primarily a dividend stock. And the stock is simply not as beaten down as it was during the worst of the cyberattack scare.

Still, Clorox is a good value. It features a 3.4% dividend yield. And although its P/E ratio is high right now, it has made meaningful cost cuts and price increases that set the stage for strong bottom-line results once Clorox has fully recovered from the cyberattack.

Target is too cheap to ignore

Like Clorox, Target suffered a massive sell-off that saw the stock trade as low as around $103 a share. Since Nov. 1, Target is up 24.9%. But it is still down in 2023 and down over 20% in the last three years.

Target has been dealing with inflationary pressures, weak consumer spending on discretionary goods, inventory challenges, and theft. The last few years have been an extremely challenging period for predicting buyer behavior, which has gone from a wave of excitement during the pandemic to more reserved today. High interest rates make borrowing money more expensive and pressure consumers to spend within their means.

Unfortunately for Target, that means a potentially subdued holiday season, which is why Target has chosen to keep a lean inventory instead of risking being over-optimistic and then having to implement steep discounts after the holidays just to move products off shelves.

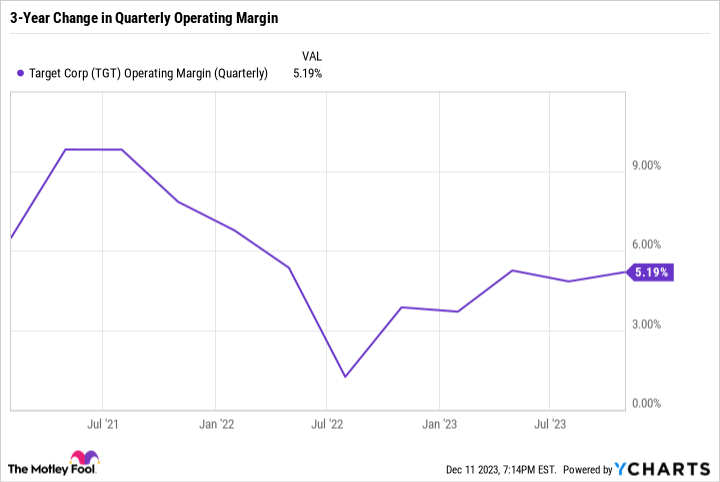

Even after the stock’s recent partial rebound, it still yields 3.2%. Like Coke, it is a Dividend King with over 50 consecutive years of dividend increases. Target also has more growth potential than Coke or Clorox. It has done an excellent job leaning into its rewards program, curbside pickup, and e-commerce. Its margins are showing signs of improvement, with last quarter’s operating margin coming in at 5.2%, which is a sizable improvement over last year’s epic margin collapse.

Target certainly isn’t out of the woods yet. And it may take a while before it fully recovers. But the stock is still cheap, trading at a 17.4 P/E ratio. That’s simply too low for a company with Target’s brand power and dividend track record.

Companies you can count on in 2024

Coke, Clorox, and Target are three stocks ideally suited for investors whose financial goals include generating a steady stream of passive income. Each stock yields over 3%, which is close to the risk-free 10-year Treasury Rate of 4.2%. Only with stocks, you get the potential reward (and take on the risk) that comes with investing.

High-quality dividend stocks like Coke, Clorox, and Target should prove to be a worthwhile investment that blends dividend income and capital gains over time.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Daniel Foelber has positions in Target and has the following options: long November 2024 $130 calls on Target and short November 2024 $135 calls on Target. The Motley Fool has positions in and recommends Target. The Motley Fool recommends the following options: long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.

3 Passive Income Powerhouses to Buy Before the End of the Year was originally published by The Motley Fool