(Bloomberg) — Global equities began September on the back foot, after four months of gains, as China’s efforts to support its ailing economy showed no signs of taking hold.

Most Read from Bloomberg

A gauge of Asian stocks fell, as did a global metric, marking the first day of trading in a typically volatile month for markets. Losses were led by Chinese stocks with New World Development Co. falling as much as 14% after the indebted property developer said it expected to post its first annual loss in two decades.

European index futures slipped, as did their US index counterparts. The dollar was steady, while purchasing managers’ surveys for Taiwan, Thailand and Indonesia all declined, weighing on their currencies. Cash Treasuries were closed for the US Labor Day holiday.

Global funds are positioning for major central banks, including the Federal Reserve, to reduce interest rates in September. At the same time, multiple rounds of stimulus have failed to revive growth in China, where a prolonged property market slump is curbing domestic demand in the world’s second-largest economy.

“I would be more worried about the China side of the equation, to be quite frank,” Carlos Casanova, a senior Asia economist at Union Bancaire Privee told Bloomberg TV. While the fourth quarter is likely to be positive for Chinese risk assets thanks to efforts to shore up domestic demand, “there’s not enough policy space to do big bazooka support measures like in 2009,” he added.

While the Caixin China manufacturing data registered an unexpected increase on Monday, it fell short of reversing sentiment after an official gauge of factory activity contracted for a fourth straight month in August. Latest home sales figures showed a worsening residential slump, after China Vanke Co. underlined the industry’s woes late Friday by reporting a half-year loss for the first time in more than two decades.

“I think there’s a huge problem — by now everybody recognizes that,” Hao Ong, chief economist at Grow Investment Group told Bloomberg’s David Ingles and Yvonne Man in an interview. “The government needs to do substantially more.”

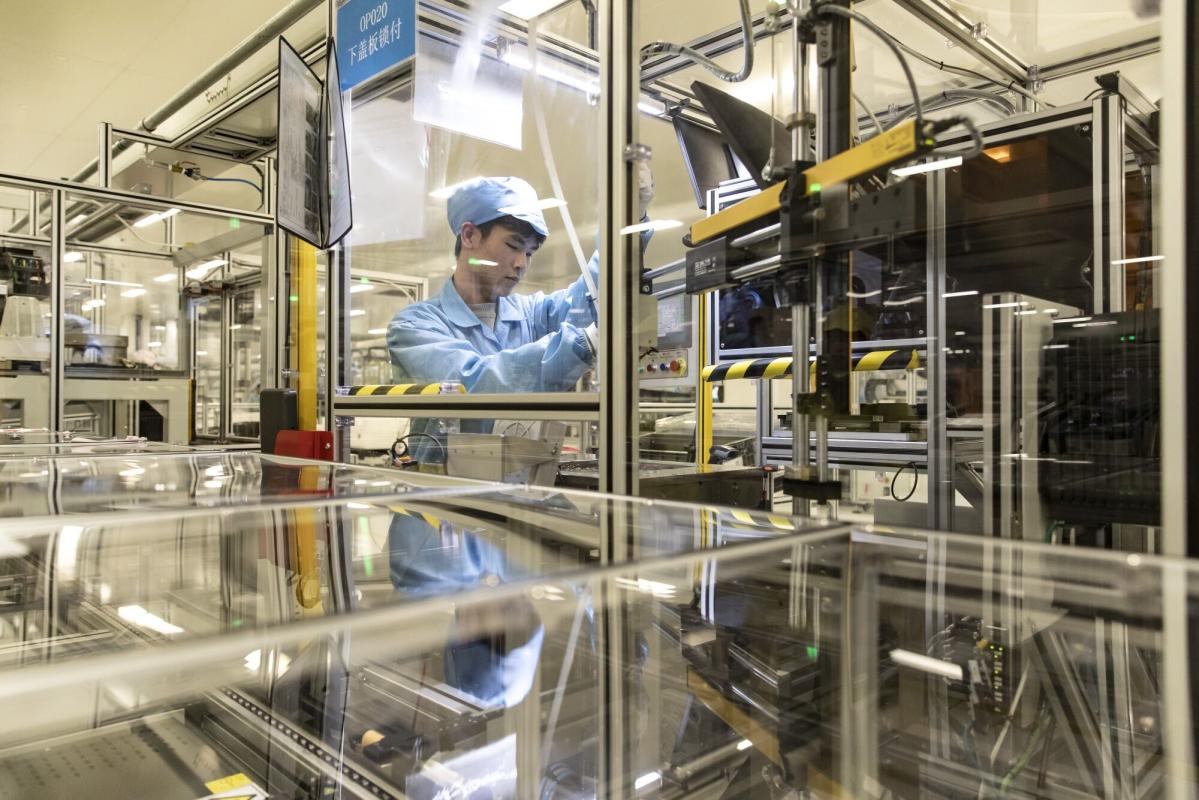

Meanwhile, in the latest spat over trade and technology, China threatened severe economic retaliation against Japan if Tokyo further restricted sales and servicing of chipmaking equipment to Chinese firms, Bloomberg reported on Monday, citing to people familiar with the matter.

September Woes

September is historically a volatile month for global markets. It’s been one of the worst months for stocks in the past four years, while the dollar typically outperforms, according to data compiled by Bloomberg. Wall Street’s fear gauge – the Cboe Volatility Index, or VIX – has risen each September the past three years, the data show.

This month may be no different with the crucial US jobs report on Friday serving as a guide to how quick, or slow, the Fed will cut rates, and as the US election campaign gets into full swing. Traders are pricing the Fed’s easing cycle will begin this month, with a roughly one-in-four chance of a 50 basis point cut, according to data compiled by Bloomberg.

“This week’s jobs data will likely be a deciding factor for the FOMC to start with a 25 or 50 basis point cut,” Paul Mackel, Global Head of FX Research at HSBC Holdings Plc wrote in a note to clients. “At the recent Jackson Hole symposium, Fed Chair Jerome Powell made specific comments about avoiding a further weakening of the employment situation.”

As for the European Central Bank, Governing Council member Francois Villeroy de Galhau backed a cut in interest rates in September, according to an interview published on Friday, after data showed a marked slowdown in inflation.

Elsewhere, German Chancellor Olaf Scholz’s ruling coalition was punished in two regional elections in east of the country on on Sunday, with the far right clinching its first triumph in a state ballot since World War II. Still, the extreme right is highly unlikely to be able to form a government, as it’s shunned by the other parties represented in parliament.

In commodities markets, oil pushed lower on signs OPEC+ will progress with a plan to lift output from October, while the economic headwinds mount in China. Gold and iron ore also declined.

Key events this week:

-

Eurozone HCOB manufacturing PMI, Monday

-

UK S&P Global manufacturing PMI, Monday

-

US markets closed for Labor Day holiday, Monday

-

South Korea CPI, Tuesday

-

Switzerland GDP, CPI, Tuesday

-

South Africa GDP, Tuesday

-

US construction spending, ISM Manufacturing index, Tuesday

-

Mexico unemployment, Tuesday

-

Brazil GDP, Tuesday

-

Chile rate decision, Tuesday

-

Australia GDP, Wednesday

-

China Caixin services PMI, Wednesday

-

Bloomberg CEO Forum in Jakarta, Wednesday

-

Eurozone HCOB services PMI, PPI, Wednesday

-

Poland rate decision, Wednesday

-

Fed’s Beige Book, Wednesday

-

Canada rate decision, Wednesday

-

South Korea GDP, Thursday

-

Malaysia rate decision, Thursday

-

Philippines CPI, Thursday

-

Taiwan CPI, Thursday

-

Thailand CPI, Thursday

-

Eurozone retail sales, Thursday

-

Germany factory orders, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Canada unemployment, Friday

-

Chile CPI, Friday

-

Colombia CPI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.1% as of 2:54 p.m. Tokyo time

-

Nikkei 225 futures (OSE) were little changed

-

Japan’s Topix rose 0.2%

-

Australia’s S&P/ASX 200 rose 0.3%

-

Hong Kong’s Hang Seng fell 1.6%

-

The Shanghai Composite fell 0.6%

-

Euro Stoxx 50 futures were unchanged

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1056

-

The Japanese yen was little changed at 146.19 per dollar

-

The offshore yuan fell 0.2% to 7.1008 per dollar

-

The Australian dollar was little changed at $0.6770

-

The British pound was little changed at $1.3132

Cryptocurrencies

-

Bitcoin fell 0.9% to $57,896.57

-

Ether fell 1.9% to $2,455.51

Bonds

Commodities

-

West Texas Intermediate crude fell 0.5% to $73.16 a barrel

-

Spot gold fell 0.3% to $2,496.79 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.