When the legendary investor Warren Buffett makes a move, Wall Street pays attention. Known as the ‘Oracle of Omaha’ and the mastermind behind Berkshire Hathaway, Buffett has amassed a fortune of over $100 billion throughout his career. Buffett’s preferred investing style has always been value investing, which entails identifying undervalued stocks with strong fundamentals.

So, it’s definitely worth nosing through Buffett’s Berkshire Hathaway portfolio to see which stocks he recently bought. And when some of those stocks also get the endorsement of one of Wall Street’s top banks, such as J.P. Morgan, it sends an even stronger signal these names could be ripe for the picking.

With this in mind, we opened up the TipRanks database to pull up the details on a pair of stocks that get a thumbs up from both of these investing institutions. Let’s take a closer look.

Capital One Financial (COF)

First up on our list is Capital One Financial, a bank holding company based in Fairfax County, Virginia. Capital One is well-known as a credit card issuer – the company’s ‘What’s in your wallet?’ tagline is ubiquitous in TV commercials. Additionally, the company is involved in retail and commercial banking, savings accounts, and automotive loans.

Capital One’s banking operations offers retail clients the advantages of no-fee banking, and access to more than 70,000 ATMs. These advantages are backed up by the bank’s assets – Capital One had $349.8 billion in total deposits as of the March 31 of this year, part of its $471.7 billion in total assets held.

The company reported its 1Q23 results at the end of April. The top-line result of $8.9 billion was down 2% year-over-year and missed the forecast by $163.8 million. At the bottom line, the bank’s adjusted EPS of $2.31 was less than half of the year-ago figure of $5.62 and fell well short of the $3.93 forecast.

The picture isn’t all gloomy, however. Capital One, at the beginning of May, declared its regular quarterly dividend, and kept the payment at 60 cents per common share. This marked the seventh straight quarter with the dividend at this level. The annualized rate, of $2.40, gives a yield of 2.6%, above the approximately 2% market average.

Buffett must think the positives far outweigh the negatives here. In Q1, he bought 9,922,000 shares of COF, a stake which is currently worth $902.4 million.

Buffett is not the only bull here. Assessing the company’s prospects, JPMorgan 5-star analyst Richard Shane believes that this is a stock to pick up and hold on to.

“We reiterate OW and see potential near-term weakness as opportunity for investors with intermediate to long-term horizons… COF has the potential to deliver the highest returns within the credit card group as solid fundamentals and adverse sentiment converge. The company has a CET1 ratio above its historical average, substantial loss reserves, and stable funding reflecting the company’s leading depository franchise (branch and on-line),” Shane opined.

These comments back up Shane’s Overweight (i.e. Buy) rating, while his $102 price target implies a potential upside of 12% for the stock. (To watch Shane’s track record, click here)

Overall, according to TipRanks, the stock has a Moderate Buy consensus rating, based on 13 recent analyst reviews that include 7 Buys, 4 Holds, and 2 Sells. The average price target, of $111.27, is more bullish than the JPM view, and suggests a 22% upside from the current trading price of $90.95. (See COF stock forecast)

HP, Inc. (HPQ)

Shifting our focus from banking to the tech industry, let’s take a closer look at HP. As a prominent name in personal computing, HP has a rich history as a descendant of Hewlett-Packard. In 2015, it separated from its parent company and now operates independently, focusing on its PC and printer divisions. Today, HP offers an extensive range of products, including PCs, laptops, printers, ink cartridges, monitors, and accessories. They have expanded their offerings to include audio-visual devices, gaming peripherals, and even high-quality printer paper.

The turn toward remote work and home office upgrades during the pandemic lockdown period proved to be a net benefit for HP, and the company saw improved sales during that time. In recent quarters, however, revenues have begun to tail off. The company is seeing a slump in demand for new PCs, partly because potential customers – both commercial and retail – made recent upgrades during the pandemic, but also because, in an increasingly uncertain economic environment, customers are starting to hold back on large purchases.

This was particularly visible in fiscal 1Q23, when HP reported a top line revenue total of $13.83 billion, a total that missed the analyst estimates by $345.6 million, and was down almost 19% year-over-year. The company’s non-GAAP earnings per share was reported as 75 cents, in-line with expectations.

While the fiscal first quarter showed weak results, HP’s outlook, reflected in its full year guidance, remains upbeat. The company is predicting EPS for 2023 in the range between $3.20 and $3.60 per share; this gives a midpoint of $3.40, well above the $3.29 consensus estimate. In addition, the company expects to see the free cash flow for the 2023 to come in between $3 billion and $3.5 billion. The midpoint of this range, $3.25 million, exceeds the $3.09 billion estimate by $160 million.

HP’s outlook is not the only bright spot. The company has been gradually raising the dividend since the end of 2015, and the most recent declaration, of a 26.25 cent common share dividend, is to be paid on July 5. At the annualized rate of $1.05 per common share, the dividend is currently yielding 3.63%.

Buffett evidently likes the investment opportunity here. The famed investor increased his existing holding in HPQ by 16,476,783 shares in 1Q23. This marked a 16% increase in his stake, which now comprises more than 120.9 million shares of HPQ, currently valued at nearly $3.59 billion.

As for JPMorgan, the firm has taken a bullish stance on HP, banking on a recovery in consumer strength and PC demand. Analyst Samik Chatterjee lays out the JPM position: “Led by our Global PC model which embeds a 21% increase in volumes for the PC end-market between 1H23 and 2H23, we are raising our PS segment forecasts for HPQ led by a favorable position in the Consumer segment, which is expected to be the primary driver of the recovery. In addition, with gross margins stabilizing following the digestion of inventory in the channel, we expect operating margin upside to stem from revenue leverage off a lean cost structure.”

In Chatterjee’s view, this supports both an Overweight (i.e. Buy) rating, and a $35 price target which indicates potential for 18% share appreciation. (To watch Chatterjee’s track record, click here)

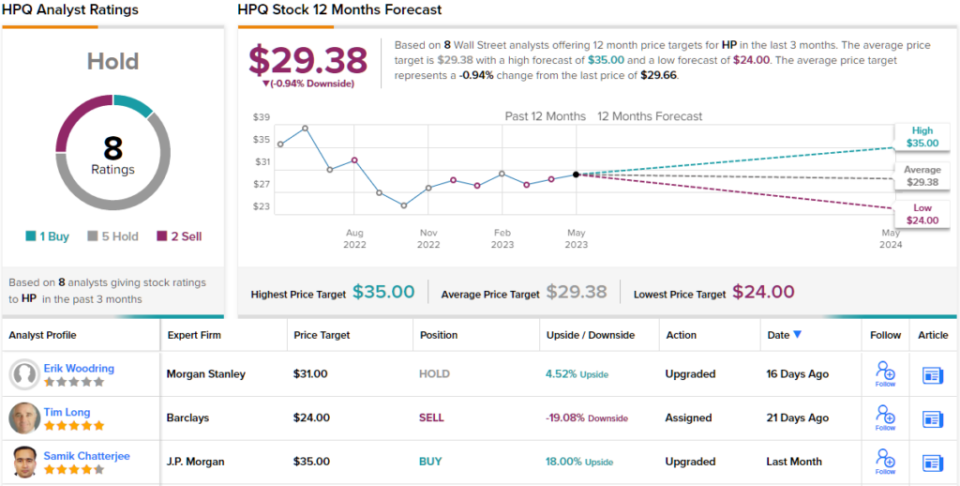

While Buffett and JPMorgan are ready to commit to HPQ, Wall Street generally is not so sure. The stock’s 8 recent analyst reviews break down to a single Buy, 5 Holds, and 2 Sells, for an analyst consensus of Hold. The stock is selling for $29.66 and the average price target, now at $29.38, suggests shares will remain range bound for the foreseeable future. (See HPQ stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.