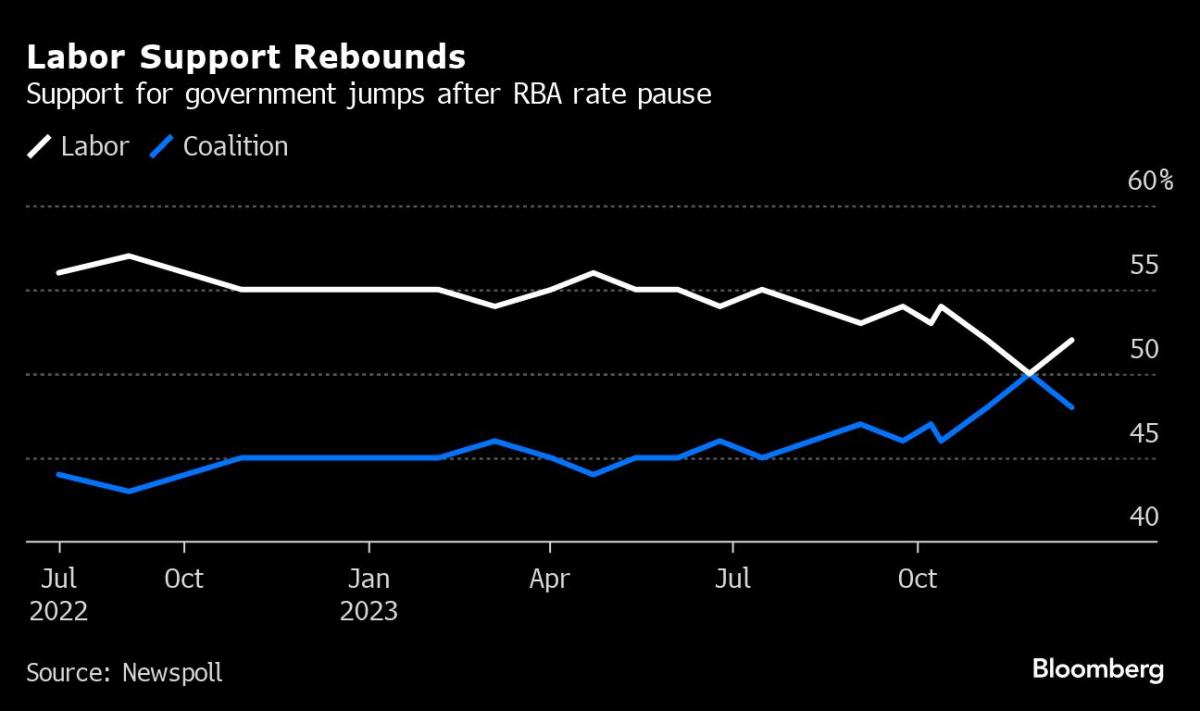

(Bloomberg) — Australia’s Labor government has regained its polling lead over the center-right opposition after the Reserve Bank kept interest rates unchanged earlier this month amid signs of cooling price pressures in the economy.

Most Read from Bloomberg

Support for Prime Minister Anthony Albanese’s Labor Party climbed to 52% on a two-party preferred basis, up from 50%, according to a Newspoll released by The Australian newspaper. The survey was conducted Dec. 11-15 and had a margin of error of 3.1 percentage points. The opposition Liberal-National coalition vote fell by the same amount — to 48% from 50%.

Labor’s improved position follows a deceleration in monthly inflation and solid employment gains that suggest cost-of-living pressures on households may be starting to ease. The center-left government has also managed to get a handle on recent political problems including a High Court ruling that asylum seekers with serious criminal records had to be released into the community.

Still, the Newspoll result is one of the government’s worst since it took office in May 2022, with Albanese himself seeing his dissatisfaction rating only falling marginally to 50% from 53%.

The government has struggled since October’s decisive defeat of a referendum for an Indigenous advisory body to Parliament. As 2023 drew to a close, it also faced the crisis over accusations it failed to prepare for the court decision on detainees.

Albanese will move to reset his political fortunes heading into 2024 — a potential election year — as he seeks to become the first Australian prime minister to win two consecutive votes since 2004.

He’s likely to be aided in the year ahead by a further slowing in inflation, the prospect of lower rates and tax cuts that will provide an economic tailwind.

Read more: Australian Budget Seen Almost in Balance This Year, Debt to Drop

The government’s fortunes received a further boost last week when Treasurer Jim Chalmers released updated figures showing the budget was expected to be basically in balance this fiscal year, compared with a deficit of A$13.9 billion ($9.3 billion) forecast in May.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.