-

A long-time market veteran anticipates a bear market and recession to hit the US.

-

Jon Wolfenbarger pointed to falling earnings and the inverted yield curve, among other factors.

-

He said the extended duration of the yield-curve inversion suggests a longer recession.

Longtime market watcher and strategist Jon Wolfenbarger expects stocks to crater and the US economy to tip into a prolonged recession.

In a note published Monday, the 32-year investing veteran pointed to several economic indicators that are flashing warnings of a downturn, as well as a deterioration in earnings, overvalued stocks, and “irrational exuberance” similar to that of the early-2000s Tech Bubble.

The Conference Board’s Leading Economic Index, for one, has continued to decline at an annualized pace only seen during recessions, he said.

On top of that, the inverted yield curve — one of the most famous predictors of a downturn that has been accurate over the prior eight recessions — has remained inverted for the longest stretch in over five decades.

“The depth of the latest yield curve inversion has only been matched or exceeded by those preceding the Great Depression and the major recessions of the mid-1970s and early 1980s,” said Wolfenbarger, who is the founder of the site Bull and Bear Profits and a former banker at JPMorgan. “That is not a comforting sign, to say the least.”

The 10-year and three-month Treasury yields remain inverted today by about 1.29%, the strategist added, and history suggests the extreme length of time it’s been flipped will lead to a longer recession than many have forecasted.

The Conference Board, for its part, predicts a coming recession to last two quarters, but Wolfenbarger disagrees.

“We expect it to likely last at least a year, based on the length of the yield curve inversion,” he maintained.

The bear case for stocks

It’s not just the economic outlook that appears bleak to Wolfenbarger. He’s bracing for a fresh bear market to begin on account of a deteriorating earnings landscape and overextended valuations.

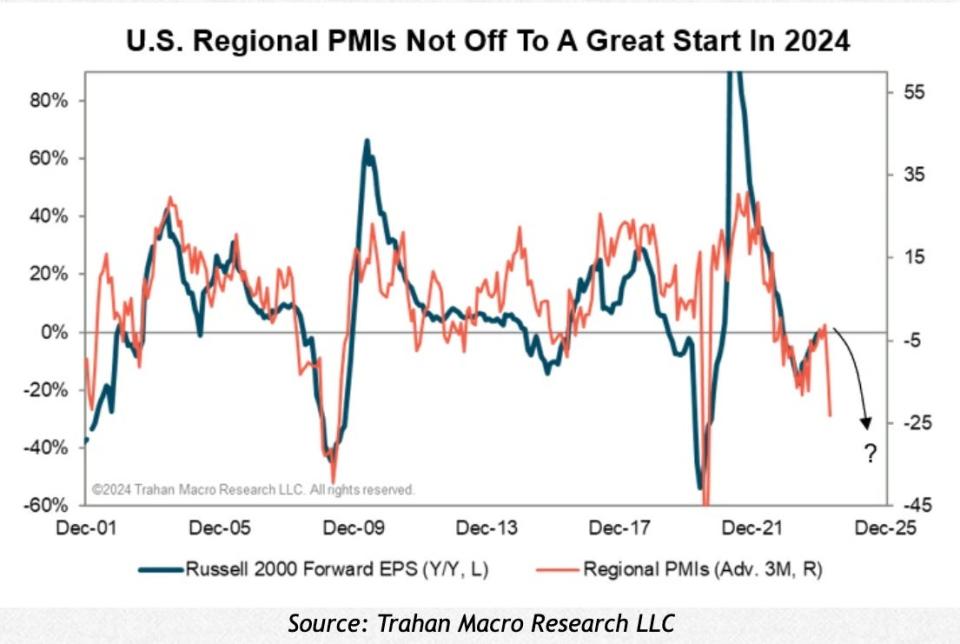

“Consistent with these bearish leading indicators, the four regional Purchasing Manager Indexes (“PMIs”) reported for January so far were very weak,” he wrote in a note, adding that most banks have missed expectations on their most recent earnings reports.

The regional PMIs typically lead forward earnings per share for the Russell 2000, as shown in the chart below.

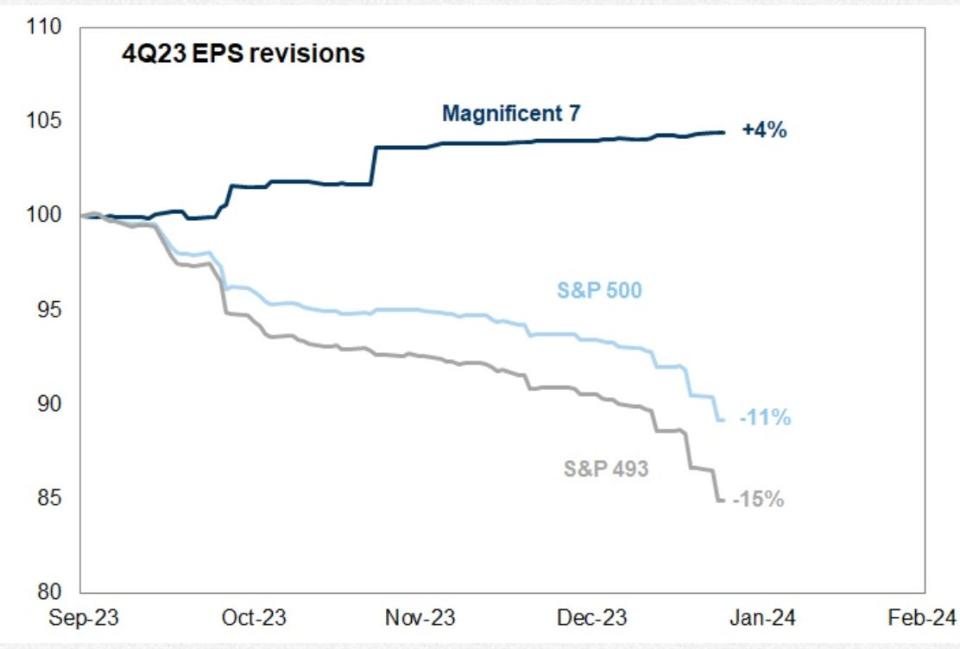

Plus, even though the “Magnificent Seven” — Apple, Amazon, Tesla, Microsoft, Nvidia, Alphabet, and Meta — have seen their fourth-quarter earnings per share revised up by 4%, the broader S&P 500 has seen a downward revision of 11%.

“A market this narrow is not a bullish market, regardless of what the headline price indexes are doing,” Wolfenbarger said.

In any case, the Big Tech stalwarts appear far overvalued and overbought at this point, in his view, and their influence has driven an “irrational exuberance” similar to that of the early 2000s, when the Nasdaq crashed about 80%.

Strategists at Amundi, a European asset-manager giant that oversees roughly $2 trillion, shared a similar outlook in a panel last week, saying that the Magnificent Seven are set to underperform in the year ahead.

“[T]he market is highly vulnerable to falling to new bear market lows,” Wolfenbarger maintained. “Most investors do not see this coming, as they are being mislead by the persistent strength of a handful of megacap Tech stocks. They have already forgotten how much those stocks fell in 2022. We believe they will be reminded soon how much overvalued Tech stocks can fall in a recession.”

Read the original article on Business Insider