From groundbreaking technological advancements to disruptive business models, each member of the “Magnificent Seven” has carved a niche for itself in the global economy. This group of megacap companies, consisting of Apple, Amazon, Alphabet, Microsoft, Meta Platforms, NVIDIA, and Tesla (NASDAQ: TSLA), represents the epitome of success, boasting market dominance, visionary leadership, and unparalleled growth prospects.

However, amid this esteemed lineup, one stock presents a particularly compelling opportunity for growth investors — Tesla.

Explaining Tesla’s recent woes

After an explosive start to the 2020s, Tesla’s stock has been on a slide since it hit its all-time high of $407 in 2021. And that slide has worsened in 2024, with shares down more than 25% this year alone.

Several factors could explain Tesla’s lack of performance, but one stands out in particular — the weakened outlook for electric vehicle (EV) sales growth in 2024. While the market is still expected to grow in 2024, forecasts project it will grow at a slower rate than previously as higher interest rates have raised the cost of purchasing a car and deterred many would-be buyers.

In addition, the customer base for electric vehicles is shrinking, at least temporarily. Many consumers who can afford new EVs and likely consider themselves trendsetters have already purchased one. The remaining customer base consists largely of those who don’t necessarily care about switching to EVs or who can’t afford one.

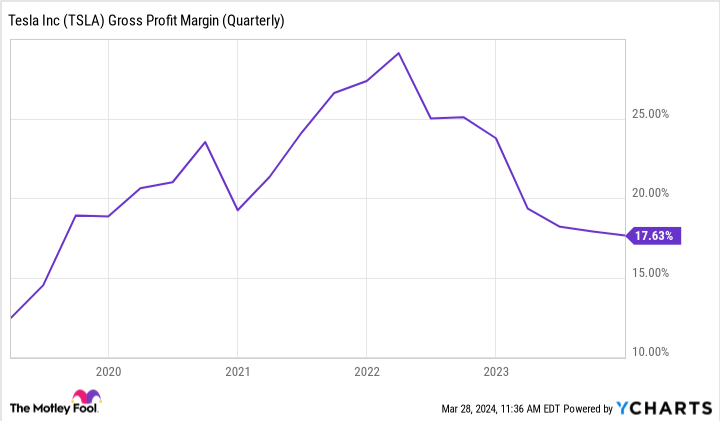

To address this, Tesla implemented a series of significant price cuts across its models in 2023. While this helped to keep demand afloat, it negatively impacted its profit margins. In 2022, Tesla’s gross profit margin reached nearly 30%, an impressive accomplishment in a capital-intensive business that put it at the top of the automotive industry by that metric. However, since the implementation of price cuts, Tesla’s margins have slipped. Today, they hover around 17%, which is more in line with the rest of the auto industry.

Adding a little context

In light of all that, it isn’t hard to see why Tesla’s stock has shed more than half its value. However, to see the opportunity presenting itself today, one must zoom out a little further and recognize just how prolific a company Tesla is, and recognize that these struggles are minor speed bumps in its growth journey.

Even amid these challenges, Tesla continued to prove why it belongs in a class of its own. In 2023, it once again set new records in total production and sales on a per-unit basis. On top of that, even with the price cuts, it set a new record on annual revenue at more than $95 billion, a new net income record of $15 billion, and bolstered its cash reserves to a whopping $29 billion.

It is this cash, in particular, that makes it attractive. Its large capital reserves give Tesla the ability to make moves that few other EV makers can afford as well in the current landscape, such as expanding its manufacturing capabilities.

The company is in the early stages of constructing a new factory in Mexico and is in preliminary discussions to build its first plants in India and Thailand. While other manufacturers have been forced to scale back operations due to higher costs and interest rates, Tesla has moved full steam ahead to increase its customer base and production capacity.

Furthermore, interest rates and weakened sales projections are possibly short-term phenomena that make Tesla equipped to weather market turbulence. Should interest rates start to come down, which is likely to occur this year, Tesla should see demand climb back.

Taking it a step further

From strictly an EV perspective, Tesla’s prospects look reasonably attractive today. However, its true potential comes into focus when analyzing the other endeavors it is pursuing. Fueled by its large cash reserves, Tesla is actively developing several promising technologies. Humanoid robots, autonomous driving, and artificial intelligence are some of its primary areas of focus today. It will pour more than $1 billion into the research and development budget for its supercomputer this year alone.

As Tesla executives described it on the most recent earnings call, the company currently finds itself between two growth cycles. The first one catapulted Tesla to the status of world’s most valuable automaker and made its Model Y the best-selling vehicle worldwide. But the coming growth cycle will be fueled by its sub-$25,000 next-gen vehicle, robotics, artificial intelligence, and much more. Once these technologies are fully developed, Musk envisions Tesla one day becoming the most valuable company in the world.

In many ways, investing in Tesla today would be similar to investing in it pre-2020. So, as many skeptics and critics foment fear, it’s worthwhile to add some context, zoom out a bit, and see where Tesla is headed relative to its current position.

While Musk has a reputation for visions of grandeur and setting overly optimistic timelines, it’s hard to dismiss his potential to eventually follow through. For investors who have some time on their side and are looking for the stock with the most potential out of the Magnificent Seven, the tumble in Tesla’s share price makes it extremely alluring.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Tesla made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of March 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. RJ Fulton has positions in Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Down More Than 50%, This “Magnificent Seven” Stock Is a Screaming Buy was originally published by The Motley Fool