The “Magnificent Seven” stocks led the broader market last year. This group of the world’s largest technology companies impressed with 2023 returns ranging between 48% and 238%. That’s impressive for companies already worth trillions of dollars in some cases!

But 2024 has represented a changing of the guard of sorts. Apple (NASDAQ: AAPL), Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), and Tesla (NASDAQ: TSLA) have hit some headwinds. The remaining group of Nvidia (NASDAQ: NVDA), Amazon (NASDAQ: AMZN), Meta Platforms (NASDAQ: META), and Microsoft (NASDAQ: MSFT) continue to rally, resembling a new group, a “Fab Four” that continues to carry the market to all-time highs.

Can they continue to separate themselves from the pack?

Forget the Magnificent Seven and embrace the Fab Four. Here is what you need to know.

A changing of the guard in 2024

Apple, Tesla, and Alphabet haven’t kept up the pace since 2024 began. Alphabet’s year-to-date gains have “only” tracked the S&P 500, while Apple and Tesla have started to slide. Apple and Tesla are reporting hiccups in their growth efforts. Tesla’s deliveries began 2024 with a thud, while Apple is dealing with weakness in China, a vital market for the iPhone maker. Meanwhile, Alphabet is experiencing its first threat to its monopoly on search engine traffic from generative artificial intelligence (AI).

These massive companies can’t maintain these tremendous investment returns if they don’t deliver the performance to back up those high expectations. Analysts have dramatically soured on Tesla’s near-term growth outlook, and Apple’s valuation got too hot for the growth it was putting on the table.

The “Fab Four” enjoy growth tailwinds

The remainder of the Magnificent Seven form the Fab Four, thanks primarily to expected tailwinds from artificial intelligence over the coming years. Nvidia dominates the market for AI chips, which are needed to power the massive computer systems that run AI. Amazon and Microsoft operate the world’s two largest cloud platforms, the underpinnings of the internet, and what will be various AI applications. Lastly, Meta Platforms is leveraging AI for digital advertising while investing heavily in augmented reality.

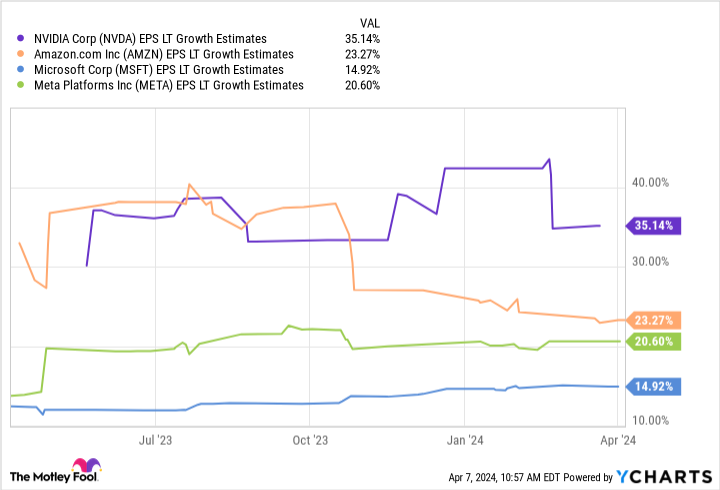

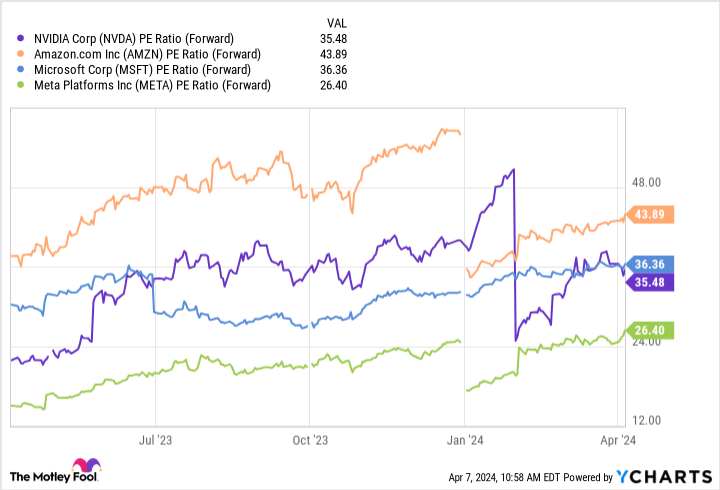

Analysts are optimistic about the growth these opportunities will create, calling for annualized long-term earnings growth ranging from 15% to 35% over the next three to five years.

Valuations say the momentum can continue

How much you pay for a stock always matters. It’s not that Tesla, Alphabet, and Apple can’t succeed in the future, but their valuations have become too disconnected from what the market expects growth to look like.

Investors can use the PEG ratio to compare a stock’s valuation to the company’s expected earnings growth to determine whether shares are still a good value.

If you use the data from the above charts, the Fab Four have the following PEG ratios:

-

Nvidia: 1

-

Amazon: 1.9

-

Microsoft: 2.4

-

Meta: 1.3

The lower the PEG ratio is, the better the value. I generally look to buy when PEG ratios are under 1.5, so Nvidia and Meta remain excellent deals if they can deliver the growth analysts expect from them. Amazon is a bit more expensive but is a more capital-intensive company. If you price the stock to its operating cash flow, its valuation is still below its decade average. Admittedly, Microsoft is beginning to look expensive, so investors may want to think twice before buying shares.

All the companies in the Magnificent Seven are among the best in their respective industries and could easily be long-term winners. But the cream eventually rises to the top, which could be Nvidia and Meta Platforms based on the numbers.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget the “Magnificent Seven,” All Eyes Should Be on the “Fab Four” was originally published by The Motley Fool