-

Nvidia’s first-quarter earnings results this week could move the whole stock market.

-

Its soaring revenue and profits have driven the bulk of the S&P 500’s earnings growth over the past year.

-

Bank of America shared how investors can hedge against the risk of Nvidia’s earnings swinging the broader market.

All eyes are on Nvidia this week as the company gears up to report its first-quarter results after the closing bell on Wednesday.

The chip maker’s earnings report could drive a big move in the stock market, both to the upside or downside, depending on how the results shake out.

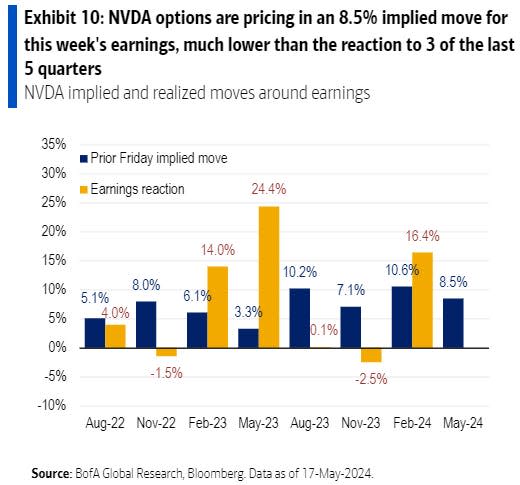

Current options pricing implies Nvidia will jump or fall 8.5% after its earnings results, which is markedly lower than prior Nvidia earnings releases when options traders were implying a move of of 14%-26%.

That’s because Nvidia and its successful lineup of AI-focused GPUs have had a massive impact on the earnings growth of the S&P 500. Over the past 12 months, Nvidia’s earnings growth drove 37% of the S&P 500’s earnings per share growth. But over the next 12 months, Nvidia’s earnings growth is expected to drive just 9% of the S&P 500’s earnings growth.

This dynamic highlights the potential market-shaking impact Nvidia could have on the broader stock market this week, and Bank of America has a way to hedge against the risk.

Instead of buying put or call options on the major indices like the S&P 500 and Nasdaq 100, Bank of America recommends investors buy call or put options on Nvidia itself.

In other words, if an investor believes the stock market is going to fall this week on Nvidia’s earnings results, instead of buying put options in the S&P 500 or Nasdaq 100, they should buy put options in Nvidia, and vice versa with call options if they believe the stock market will rise.

“For those worried about the (positive or negative) impact of NVDA earnings on the broader market, NVDA options offer better value than hedging through indices like QQQ, SPY, SMH (Semis ETF),” Bank of America said.

The reason is that Nvidia options cost less than options on the broader indices, according to the bank, likely due to the strong liquidity and trading interest in the AI giant.

“Don’t mess with proxies; hedge with NVDA options,” Bank of America said.

Read the original article on Business Insider