(Bloomberg) — Asian stocks gained while the dollar softened amid bets that the Federal Reserve will cut interest rates this year, with US inflation data due this week likely to signal easing price pressure.

Most Read from Bloomberg

Stock markets in Hong Kong, China, Australia, South Korea and Japan climbed on Monday, while US equity futures were little changed. The Australian dollar, the euro and the yen strengthened versus the dollar, with Bank of Japan Deputy Governor Shinichi Uchida saying the end of the battle with deflation was in sight.

Global investors are hopeful that the Fed, along with the European Central Bank and its peers, will reduce interest rates this year. This, along with strong company earnings and signals from US officials that further rate hikes are unlikely, has boosted investor sentiment.

While economists are now expecting fewer Fed cuts than they did previously, “the markets have said – doesn’t matter – we’ve got stronger profit numbers,” Shane Oliver of AMP Capital Markets Ltd. told Bloomberg Television an interview. “That’s kept markets going.”

A swath of inflation prints from Australia to Japan, the Eurozone and the US is due this week as traders finesse bets on the outlook for monetary policy.

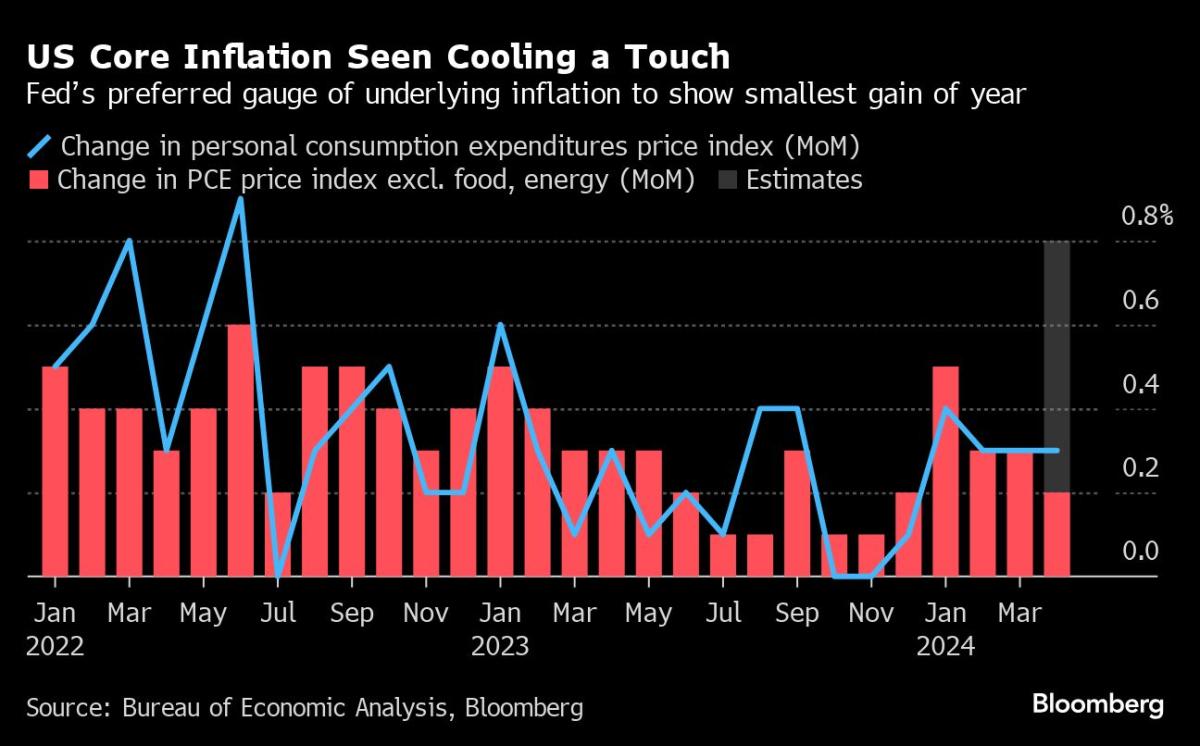

The ECB is widely expected to cut rates for the first time since concluding an unprecedented tightening campaign at its June meeting. But US officials are progressing toward a pivot at a slower pace, with Fed Chair Jerome Powell stressing the need for more evidence that inflation is on a sustained path to their 2% goal before cutting the policy benchmark.

Still, Wall Street got a degree of relief last week when University of Michigan figures showed consumers expect prices to climb less quickly than previously indicated.

“Risk sentiment is upbeat after softer inflation expectations” thanks to US data, said Charu Chanana of Saxo Capital Markets.

The Federal Reserve’s first-line inflation gauge — due on Friday — is set to show some modest relief from stubborn price pressures. John Williams, Lisa Cook, Neel Kashkari and Lorie Logan are among the US central bankers due to speak.

Read More: About the ‘T+1’ Rule Making US Stocks Settle in a Day: QuickTake

Trading of cash Treasuries was closed. British and US markets are closed Monday for holidays. That means the “T+1” rule that has the potential to cause trouble for overseas investors will come into effect when traders come back from the long weekend — making US equities settle in one day rather than two.

In commodities, oil and gold rose. This year has witnessed a rolling series of commodity price spikes thanks to supply constraints, surging demand and even some speculative activity. The Organization of Petroleum Exporting Countries and its partners are set to gather online on June 2 to discuss supply cuts.

Some key events this week:

-

ECB’s Philip Lane speaks in Dublin on inflation, Monday

-

IMF holds discussions with Ukrainian authorities to review economic policies as the country seeks to unlock next tranche of $2.2 billion in aid, Monday

-

Cleveland Fed President Loretta Mester speaks at BOJ event in Tokyo; Minneapolis Fed President Neel Kashkari and ECB Governing Council member Klaas Knot address Barclays-CEPR International Monetary Policy forum, Tuesday

-

South African election, the most significant since the end of apartheid, Wednesday

-

Fed releases Beige Book economic survey, Wednesday

-

South Africa rate decision, US initial jobless claims, GDP, wholesale inventories, Thursday

-

New York Fed President John Williams speaks at the Economic Club of New York, Thursday

-

GDP data published for Canada, Eurozone, Turkey, Friday

-

Japan unemployment, Tokyo CPI, industrial production, retail sales, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 12:22 p.m. Tokyo time

-

Nikkei 225 futures (OSE) rose 0.3%

-

Japan’s Topix rose 0.3%

-

Australia’s S&P/ASX 200 rose 0.7%

-

Hong Kong’s Hang Seng rose 0.4%

-

The Shanghai Composite rose 0.3%

-

Euro Stoxx 50 futures fell 0.1%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0850

-

The Japanese yen rose 0.1% to 156.76 per dollar

-

The offshore yuan was little changed at 7.2572 per dollar

Cryptocurrencies

-

Bitcoin rose 0.5% to $69,016.01

-

Ether rose 1.7% to $3,924.89

Bonds

Commodities

-

West Texas Intermediate crude rose 0.3% to $77.97 a barrel

-

Spot gold rose 0.5% to $2,344.94 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Matthew Burgess.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.