Every day, tens of thousands of market traders deal in thousands of stocks, conducting multiple millions of transactions – and generating an enormous flood of raw data. That data contains everything the average investor needs to know about any stock in the market – but finding it is the problem. The sheer volume of stock market information is by itself a barrier to successful investing.

This is the problem that the TipRanks Smart Score was designed to solve. The Smart Score is a sophisticated data crunching algorithm, using AI and natural language processing to pan the stream of market data and extract the valuable nuggets. The algorithms scan every stock out there, and compare them to a set of factors that are known to predict future outperformance – and then each stock is given a score, a simple rating on a scale of 1 to 10, to show investors how a given stock is likely to perform in the near future. A ‘Perfect 10’ indicates shares that are primed for gains.

On a practical side, we can dip into the Smart Score tool to find stocks that boast that Perfect 10 score – and that have recent solid ratings from the Street’s analysts. Here is the lowdown on two of them.

Flutter Entertainment (FLUT)

We’ll start with one of the world’s largest iGaming and sports betting operators, Flutter Entertainment. This company reported a global total of 12.3 million average monthly players last year, across all of its betting and gaming brands. Flutter operates as a parent company, and its 15 brands include major names in the industry, such as Paddy Power, PokerStars, and Betfair.

The company’s high player count last year translated into significant income. The company’s 2023 revenue total came to $11.8 billion, and Flutter was able to invest $100 million into safe gambling initiatives during the year. The income stream came from Flutter’s four geographical divisions – US, UKI, Australia, and International – with the English-language divisions making up 76% of the total global footprint. The company’s US division generated 38% of the 2023 revenue total. As of 4Q23, Flutter claimed to have a 53% market share in the sportsbook segment, and a 26% market share in the iGaming segment.

In its most recent quarterly report, covering 1Q24, Flutter reported quarterly revenue of $3.4 billion, a figure that was up more than 16% year-over-year but came in slightly below the forecast, missing by $160 million. Flutter’s cash position improved year-over-year, and the company reported a strong increase in adjusted free cash flow, which got out of the negative and rose $207 million to reach $157 million.

This stock’s solid position in its industry leads Oppenheimer analyst Jed Kelly to initiate his coverage of the shares with an upbeat outlook, noting the company’s potential for growth in the US.

“We expect Flutter’s FanDuel (FD) brand to maintain its leading US market share from FLUT’s global OSB/iGaming platforms providing players an engaging/localized experience at industry leading win margins to acquire and retain more customers at higher incremental gross profit dollars versus competitors. We believe FLUT is best positioned to navigate states potentially increasing online wagering taxes based on its International scale, operational experience, and higher unit economics,” Kelly opined.

Kelly goes on to explain just why he believes the shares are primed to bring returns going forward, adding, “We see recent pullback creating an attractive setup for investors, and expect multiple expansion (currently 13.6x ’25E EBITDA) from US EBITDA growing 52% ‘24E-‘26E CAGR and validating FD moat thesis.”

These comments support Kelly’s Outperform (i.e. Buy) rating on FLUT shares, and his price target of $240 implies a one-year potential gain of 25%. (To watch Kelly’s track record, click here)

It’s clear from the Smart Score and the analyst consensus that the upbeat Oppenheimer take is not an outlier; the shares have 17 recent analyst reviews that break down to 15 Buys and 2 Holds, for a Strong Buy consensus rating. The ‘Perfect 10’ stock is currently priced at $191.70 and its $260.07 average price target is even more bullish than Kelly’s, suggesting a ~36% upside on the one-year horizon. (See FLUT stock analysis)

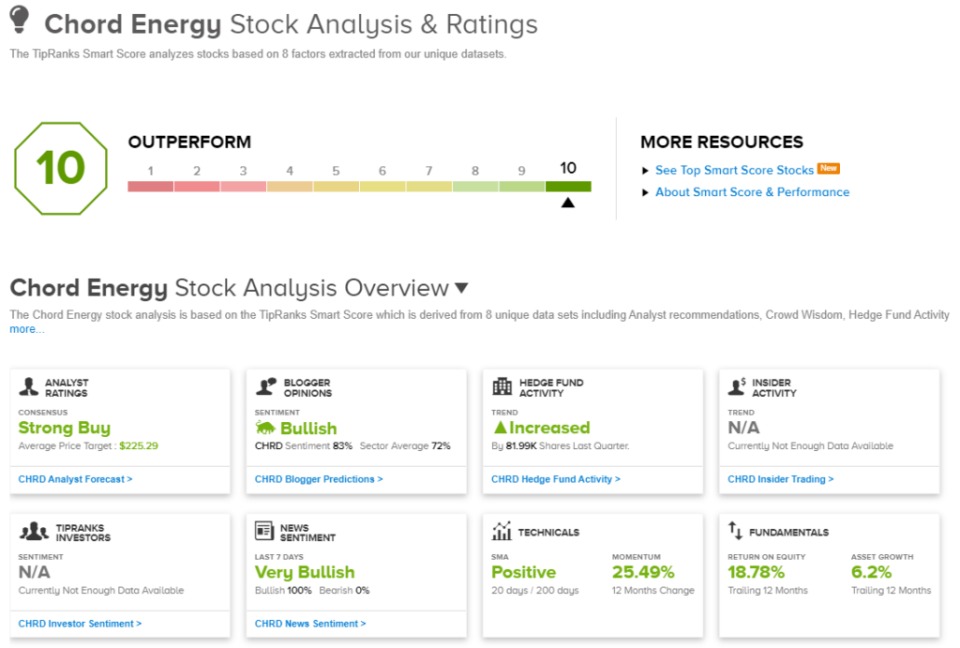

Chord Energy (CHRD)

The second ‘Perfect 10’ stock we’ll look at is Chord Energy, one of the main operators in the Williston Basin of the northern Great Plains. Specifically, Chord operates primarily in the Bakken Shale, the oil-rich shale formation that spreads across northern North Dakota and Montana and into Canada. The company has over 126,000 net acres in this region, with 6 operating rigs its holdings. Of the company’s reserves, approximately 57% are petroleum.

During the first quarter of this year, Chord achieved 99 MBopd in crude oil production, 34.4 MBblpd of natural gas liquid production, and 209.8 MMcfpd of natural gas output. The company’s total production figure was listed as 168.4 MBoepd, with 58.8% of that total being crude oil. The company’s total hydrocarbon revenues – from crude oil, natural gas, and natural gas liquids – came to $748.3 million, down 2.3% from the prior year.

The complete top line for the quarter, including purchased oil and gas sales, came to $1.09 billion, up more than 21% year-over-year and more than $323 million ahead of the forecast. The company’s quarterly EPS, of $4.65, was in-line with expectations.

Moreover, Chord made headlines with its strategic acquisition of Enerplus, a major Canadian independent oil and gas producer, valued at $4 billion. This transaction, executed in both cash and stock, was finalized on May 31. The combined company boasts a total of 1.3 million net acres in the Bakken formation, and combined Q4 2023 production of 287 MBoepd. Chord’s Q2 2024 report will be the first to include post-merger results.

The Enerplus acquisition, and the potential it can unlock, are key points here, according to BMO analyst Phillip Jungwirth. The analyst says of Chord, “We like the company’s strong FCF yield and low leverage, which enable strong capital returns… Chord closed its ~$4bn acquisition of Enerplus, resulting in a ~$12bn enterprise value, along with over one million acres in the Bakken, 10 years of inventory, and ~270MBoe/d of production. While integration will be a focus near term, we believe Chord has good runway to continuing to grow its Bakken footprint. This should improve relative valuation with the shares only trading near SMID E&P peers, and a ~0.5-1.0x discount to large-cap E&Ps.”

Looking ahead, Jungwirth puts an Outperform (i.e. Buy) rating on CHRD, and gives the stock a $230 price target that points toward a 33% share price increase over the next 12 months. (To watch Jungwirth’s track record, click here)

Jungwirth’s colleagues also think CHRD is well-positioned to deliver. The stock has a Strong Buy consensus rating, based on a unanimous 7 Buy recommendations. The forecast is for one-year gains of ~30%, given the average price target currently stands at $225.29. (See Chord’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.