-

A debt ceiling deal surprisingly green-lit the Mountain Valley Pipeline.

-

A trader bought 100,000 call options on the pipeline’s owner days before that was announced.

-

The identity of the mystery trader is unknown, and some think it’s an insider trading concern.

As part of the debt ceiling deal, one surprise concession that made it into the bill was the approval of the Mountain Valley Pipeline, a 304-mile natural gas connection from northwest West Virginia to southern Virginia.

A pet project of West Virginia Sen. Joe Manchin that had been mired in Congress, the law forces action on permits that should push the project forward.

However, there was no public reason to believe that the pipeline was in the deal at all, which makes the actions of one mystery trader — who made a killing on its inclusion — somewhat suspicious, according to a Bloomberg analysis of trading data.

Shares in Equitrans Midstream Corporation were down 35% last year. On May 24, a few days before an agreement was struck, a mystery trader bought 100,000 call options — essentially bets on a stock-price increase — on Equitrans Midstream. Then, on May 27, the debt deal including the Mountain Valley Pipeline was struck.

Following that announcement, Equitrans Midstream shares jumped 49%.

From the looks of it, the bet earned the trader $7.5 million as of last Friday, according to Bloomberg. The options are still outstanding, so that number could grow in the event that Equitrans Midstream continues to rally.

That kind of perfect timing is, needless to say, fishy. The deal on Mountain Valley was kept secret up until the debt deal was announced. Some are suspicious enough they want it investigated for potential insider trading.

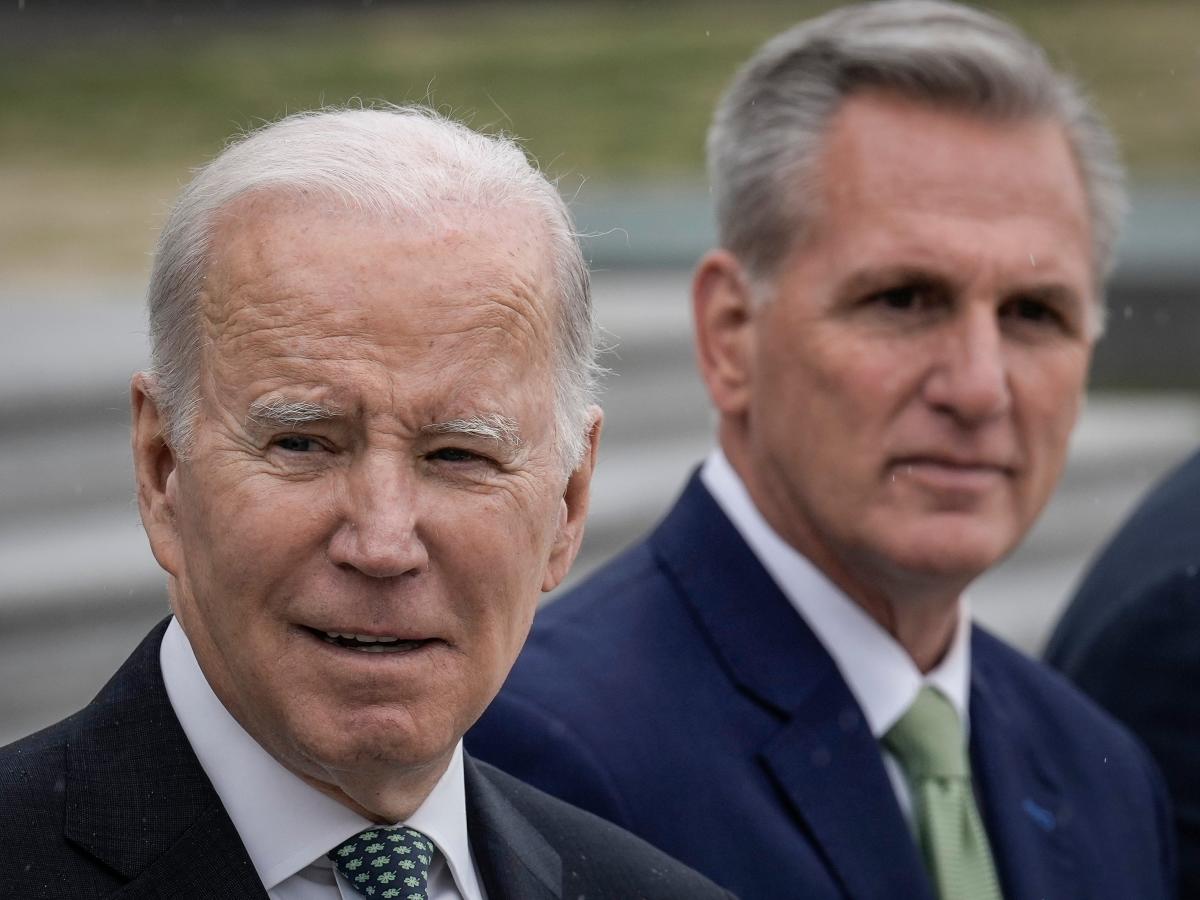

Equitrans said neither they nor any executives were involved in the transactions. Manchin himself said he knew nothing about the options trade. The negotiations were played very close to the vest between House Speaker Kevin McCarthy and the White House. Ethics watchdogs want answers, according to Bloomberg.

Members of Congress are barred from trading on confidential information, though a 2021 Insider investigation found repeated violations of the STOCK Act among members.

Read the original article on Business Insider