-

Unrealized upside exists in three underbought areas of the stock market, JPMorgan Asset Management says.

-

They include the semiconductor, rail and parcel, and home improvement sectors, according to the firm.

-

Those could be great portfolio adds as earnings growth in AI stocks starts to slow, strategists said.

Investors are still overtaken by the frenzy for generative AI — but there are underappreciated areas of the market that could offer gains like “coiled springs,” according to JPMorgan Asset Management.

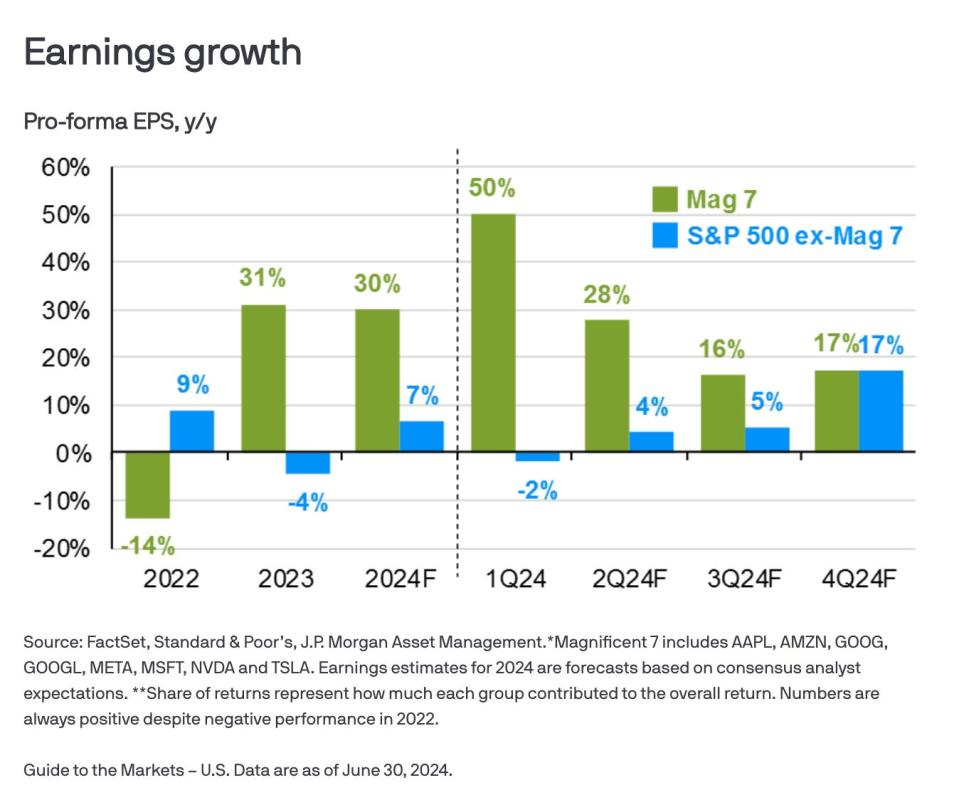

While the Magnificent Seven stocks — which include tech giants like Nvidia, Meta, and Microsoft — saw 50% annualized earnings-per-share growth in the first quarter, the rest of the S&P 500 is due to catch up.

By the fourth quarter of 2024, JPMorgan expects earnings expansion for the other 493 S&P 500 stocks to match that of the Magnificent 7, a dynamic shown in the chart below.

“Taking a longer-term view, significant fiscal spending, particularly on infrastructure (such as the Inflation Reduction Act and the CHIPS and Science Act), coupled with growing enthusiasm around generative Artificial Intelligence, should provide an accommodative backdrop for stronger secular growth moving forward,” strategists said. “Markets don’t seem to have fully priced in this prognosis, reflected in the narrow (and narrowing) nature of the equity market rally.”

Investors looking for unrealized upside would be well-served to seek non-Mag 7 stocks with “depressed” valuations that aren’t yet pricing in the earnings-growth catchup.

“These names could therefore function like ‘coiled springs,'” the note added, highlighting three particular industries:

Semiconductors. JPMorgan says there is plenty of opportunity in semis outside of the AI trade.

“Depressed areas like personal electronics, communications and enterprise, may soon bounce back as demand is reinvigorated off low levels left behind by pandemic ‘over-ordering,'” the firm wrote.

Rail and parcel. These stocks are bound to see upside due to “unexpected resiliency” in the US economy and the rising need to transport materials. Automation in the industry is also expected to increase efficiency, which could boost upside.

Home improvement. Americans have put a pause on their home renovations, held back by high interest rates and the fact that many already renovated their homes during the pandemic. But that trend is likely to reverse in the future, strategists said.

“With the average US home age increasing, the likelihood of significant maintenance expenditure is increasing. Moreover, labor-related backlogs in older projects are clearing, as immigration has helped solve labor shortages,” they said.

JPMorgan’s suggestions are indicative of Wall Street’s shift towards recommending diversification, rather than continuing to chase Mag 7 gains. This has been the case as uncertainty swirls around the election and Fed rate cuts in the year ahead. Some defensive investments, like energy and utility stocks, have seen outsized gains over the past year, with returns surpassing even top AI picks like Nvidia.

Read the original article on Business Insider