-

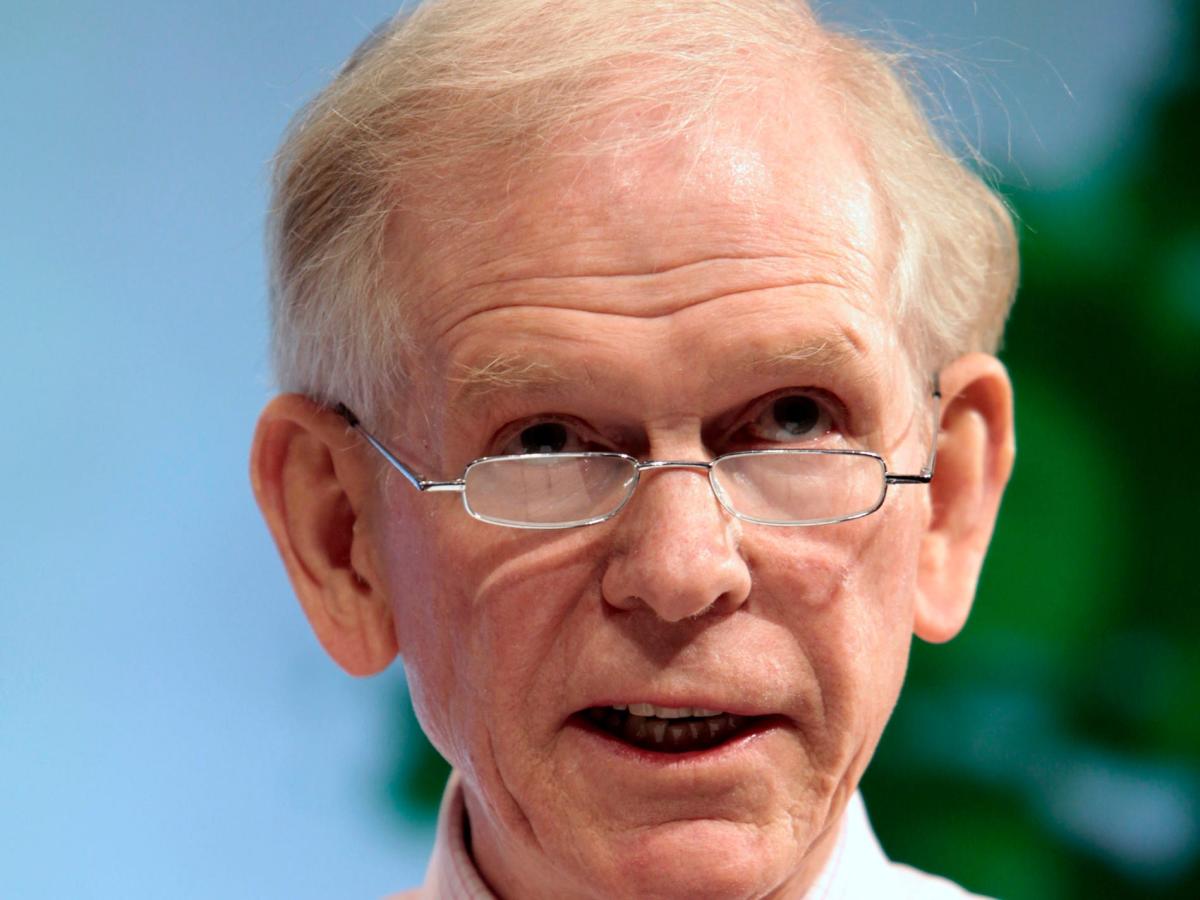

Jeremy Grantham expects US house prices to slide over the next few years.

-

The GMO cofounder sees the S&P 500 plunging as low as 2,000 points, a 52% drop.

-

The elite investor warns the recent banking turmoil may strain other parts of the financial system.

Prepare for a prolonged decline in US house prices, a potential 52% plunge in the S&P 500, and more banking problems, Jeremy Grantham has warned.

American homes are very expensive relative to household incomes, and surging mortgage costs have eroded people’s homebuying power, the market historian and GMO cofounder told CityWire in a recent interview.

As people gradually realize their properties are worth far less than they thought, they’re likely to feel poorer and cut back on foreign trips, graduate schooling, and other big-ticket items, Grantham predicted. The decline in spending could temper economic growth, he noted.

“It doesn’t happen overnight, but housing casts a very long shadow and economically is more dangerous than the stock market,” Grantham said. “The bad news is it moves very slowly. The peak last time was 2006 and it didn’t trough until 2012 — it took six years.”

“I don’t expect a crash but I expect house prices to drift back into more affordability,” he added.

The veteran investor sounded the alarm on a “superbubble” spanning stocks, bonds, and real estate in January 2022. He partly blamed the asset-price boom on near-zero interest rates, which encouraged spending over saving and made it very cheap to borrow.

However, in a bid to curb historic inflation, the Federal Reserve has hiked rates to about 5% over the past 13 months or so. The US central bank’s actions have raised the cost of mortgages, car loans, credit cards and other types of debt.

In addition to a housing downturn, Grantham predicted a sharp decline in stocks. The S&P 500 is likely to plunge between 27% and 52% from its current level of 4,130 points, he told CityWire.

“The best we could hope for is that this market would bottom at about 3,000,” he said. “The worst we should fear is more like 2,000.”

Knowing that might sound extreme, Grantham noted the benchmark index touched 666 points in 2009, meaning if it bottoms at 2,000 points this time around, it will still have tripled over the past 14 years.

Grantham also nodded to the collapse of Silicon Valley Bank and Signature Bank in March, which sent shockwaves through the financial system and has stoked fears of a credit crunch. He advised fixed-income investors to be careful, as further banking turmoil could threaten the attractive yields on bonds.

“We do appear to be running the possibility of a rolling financial stress,” he said.

Read the original article on Business Insider