Warren Buffett turned Berkshire Hathaway into one of the largest companies in the world through a litany of shrewd investments. In fact, its stock price has skyrocketed more than 4,300,000% since he took control in 1965. That accomplishment has made Buffett one of the most revered figures in the financial world.

Surprisingly, Buffett has never recommended Berkshire stock. Instead, he has regularly advised investors to periodically purchase shares of an index fund that tracks the S&P 500 (SNPINDEX: ^GSPC). That strategy provides diversified exposure to hundreds of American businesses that are collectively “bound to do well” over time, according to Buffett.

Indeed, history says investors can build an $903,800 portfolio over three decades by simply investing $350 per month in an S&P 500 index fund. Here’s how.

The Vanguard S&P 500 ETF provides diversified exposure to hundreds of U.S. companies

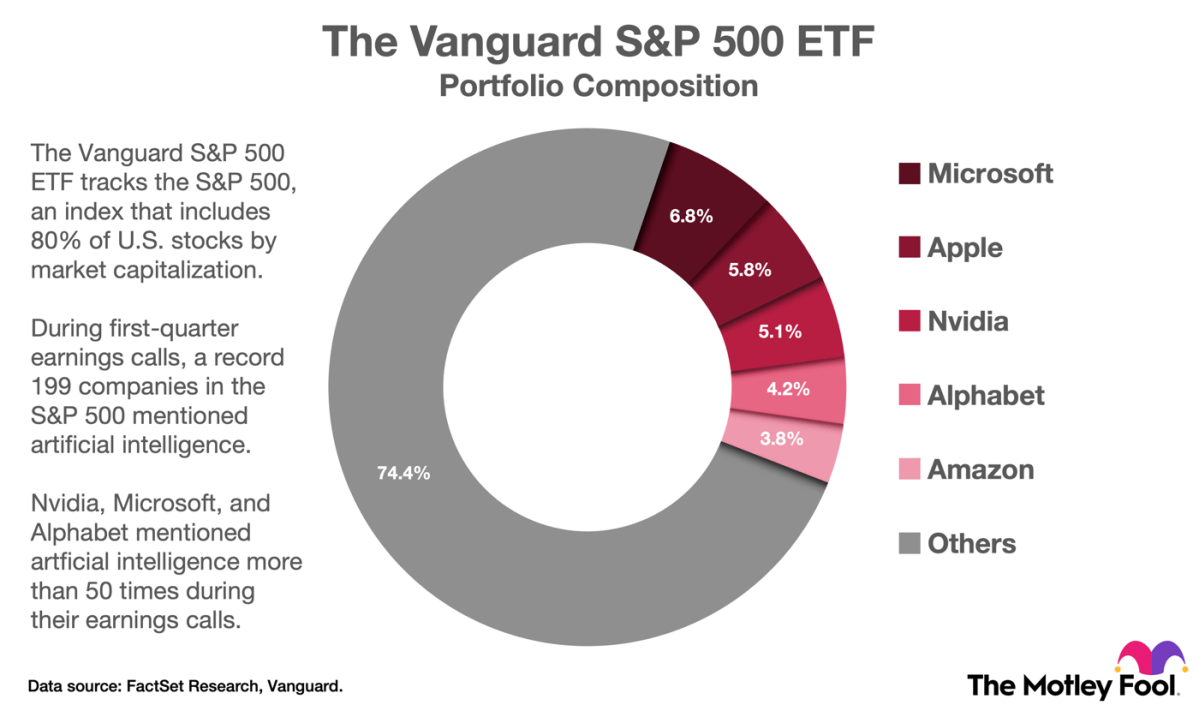

The Vanguard S&P 500 ETF (NYSEMKT: VOO) measures the performance of 500 U.S. companies, a blend of value stocks and growth stocks from every market sector. The index fund covers about 80% of U.S. equities and nearly 50% of global equities by market capitalization, meaning it spreads money across many of the most influential companies in the world.

One tailwind that should send the S&P 500 higher in future years is artificial intelligence (AI). Just as e-commerce, mobile connectivity, and cloud computing drove the index higher in past years, many experts see AI as the next generation-defining investment theme. Indeed, the five largest holdings in the Vanguard S&P 500 ETF (shown in the chart) are all well positioned to monetize AI in the future.

Here’s a look at each company.

Microsoft (NASDAQ: MSFT) is the largest enterprise software vendor and the second-largest cloud computing provider. The company is monetizing artificial intelligence with generative AI Copilots for its software products, and cloud AI services. Most notably, Microsoft Azure lets developers build generative AI applications with large language models from ChatGPT creator OpenAI.

Apple (NASDAQ: AAPL) has cultivated brand authority across several consumer electronics verticals, and it has a particularly strong market presence in smartphones. The company undoubtedly lags its big tech peers in monetizing artificial intelligence, but upcoming versions of iOS will reportedly feature AI-powered search, summaries, photo editing, and other automations.

Nvidia (NASDAQ: NVDA) graphics processing units (GPUs) offer unparalleled performance when accelerating data center workloads like artificial intelligence applications. The company holds more than 80% market share in AI chips, and its extensive product ecosystem — spanning hardware, software, and services — makes Nvidia a one-stop shop for building entire AI data centers.

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is the market leader in digital advertising and the third-largest cloud computing provider, and it’s leaning into artificial intelligence across both product categories with its Gemini model. Specifically, Gemini simplifies ad campaign creation with natural language, supports the development of generative AI applications, and automates work in its office productivity suite Google Workspace.

Amazon (NASDAQ: AMZN) enjoys a leadership position in e-commerce, retail advertising, and cloud computing, and the company is using artificial intelligence across all three product categories. Rufus is an AI-powered shopping assistant, Amazon Ads offers generative AI for creating brand images, and Amazon Bedrock is a cloud service for developing generative AI applications.

The Vanguard S&P 500 is a cheap, easy way to build wealth

The S&P 500 is a proven moneymaker. The index outperformed virtually every other asset class over the last two decades, from international equities and fixed income to real estate and precious metals, and it has been a profitable investment over every 20-year period in history.

The S&P 500 returned 1,970% over the last 30 years, compounding at 10.62% annually. At that pace, $350 invested monthly would be worth $74,200 in one decade, $288,100 in two decades, and $903,800 in three decades. Of course, past performance is never a guarantee of future returns, but even a more conservative growth rate of 10% annually would turn $350 invested monthly into $791,000 over three decades.

Warren Buffett believes “American business — and consequently a basket of stocks — is virtually certain to be worth far more in the years ahead.” His logic is simple: The U.S. is the largest and arguably the most innovative economy in the world. Indeed, 16 of the 20 largest companies in the world are U.S. companies, and the U.S. stock market is by far the largest.

That makes a compelling argument for investing in U.S. stocks, and the Vanguard S&P 500 ETF is essentially a basket of the most successful U.S. companies. Additionally, with an expense ratio of just 0.03%, meaning the annual fees will total $3 for every $10,000 invested, the index fund is a cheap and easy way to build wealth.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Warren Buffett Recommends This Index Fund. It Could Turn $350 Per Month Into $903,800, With Help From AI Stocks. was originally published by The Motley Fool